Gartner’s Nick Jones addressed this question in a blog post yesterday. He refers to the “rule of three” which conjectures that no more than three large vendors can succeed in a mature market. If this applies in mobile, then we will see no more than three survivors, after failures and consolidation, from the following group plus any I’ve missed. I have shown platforms that have common ownership and are already slated to be replaced in strikeout format.

- Apple iOS

- Google Android

- Samsung Bada

MaemoMeeGoRIM BlackBerry OSBlackBerry Tablet OS (QNX)- HP/Palm WebOS

- Symbian

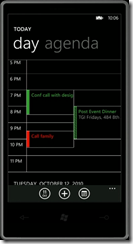

Windows MobileWindows Phone 7 and successors

Jones says that success requires differentiation, critical mass, and a large handset manufacturer. I am not sure that the last two are really distinct. It is easy to fall into the tautology trap: to be successful a platform needs to be successful. Quite so; but what we are after is the magic ingredient(s) that make it so.

Drawing up a list like this is hard, since some operating systems are more distinct than others. Android, Bada, MeeGo and WebOS are all Linux-based; iOS is also a Unix-like OS. Windows Mobile and Windows Phone 7 are both based on Windows CE.

While it seems obvious that not all the above will prosper, I am not sure that the rule of three applies. I agree that it is unlikely that mobile app vendors will want to support and build 8 or more versions of each app in order to cover the whole market; but this problem does not apply to web apps, and cross-platform frameworks and runtimes can solve the problem to some extent – things like Adobe AIR for mobile, PhoneGap and Appcelerator. Further, there will probably always be mobile devices on which few if any apps are installed, where the user will not care about the OS or application store.

Still, pick your winners. Gartner is betting on iOS and Android, predicting decline for RIM and Symbian, and projecting a small 3.9% share for Microsoft by 2014.

I am sure there will be surprises. The question of mobile OS market share should not be seen in isolation, but as part of a bigger picture in which cloud+device dominates computing. Microsoft has an opportunity here, because in theory it can offer smooth migration to existing Microsoft-platform businesses, taking advantage of their investment – or lock-in – to Active Directory, Exchange, Office and .NET. In the cloud that makes Microsoft BPOS and Azure attractive, while a mobile device with great support for Exchange and SharePoint, for example, is attractive to businesses that already use these platforms.

The cloud will be a big influence at the consumer end too. There is talk of a Facebook phone which could disrupt the market; but I wonder if we will see the existing Facebook and Microsoft partnership strengthen once people realise that Windows Phone 7 has, from what I have seen, the best Facebook integration out there.

So there are two reasons why Gartner may have under-rated Microsoft’s prospects. Equally, you can argue that Microsoft is too late into this market, with Android perfectly positioned to occupy the same position with respect to Apple that worked so well for Microsoft on the desktop.

It is all too early to call. The best advice is to build in the cloud and plan for change when it comes to devices.