Microsoft has released its financial results for the third quarter of its financial year. Revenue was up 8% year on year, and operating income up 6%. I’m always interested in the segmentation of the figures so here is a quick table:

Quarter ending March 31st 2017 vs quarter ending March 31st 2016, $millions

| Segment | Revenue | Change | Operating income | Change |

| Productivity and Business Processes | 7958 | +1437 | 2783 | -198 |

| Intelligent Cloud | 6763 | +667 | 2181 | +5 |

| More Personal Computing | 8836 | -703 | 2097 | +346 |

| Corporate and Other | -1467 | +158 | -1467 | +158 |

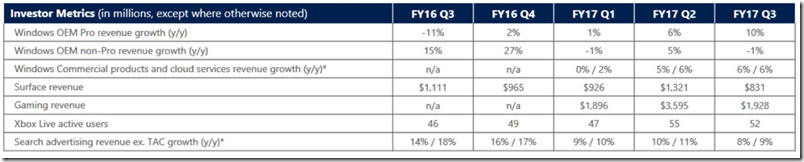

There is a bit more detail in the earnings slide:

A few points of note:

Cloud growth remains on track. Office 365 business revenue is up 45% year on year, according to Microsoft. Dynamics 365 revenue is up 81%. Azure revenue is up 93%. Of course these figures are offset by static or declining sales of on-premises licenses, though Microsoft does not spell this out precisely.

Windows is not doing too badly, despite continuing weakness in the PC market. OEM revenue up 5%, which the company attributes to “a higher mix of premium SKUs”. Surface is weak. Revenue is down 26%. Microsoft blames “heightened price competition and product end of lifecycle dynamics.” The truth is that the Surface range is not good value versus the competition. There should be a perfect marriage of hardware and software, given that it is all Microsoft, but instead there have been too many little issues. The likes of HP and Dell do a better job at lower price and with easier upgradeability.

“We had no material phone revenue this quarter” says Microsoft. I remain sad about the killing of Windows Phone, and regard it as a mistake, but that is a done deal.

Xbox is doing OK. Xbox live revenue growth has offset declining hardware sales.

Search revenue is up 8%. Nobody pays for search, so this is about advertising. Windows 10 drives users to “Cortana” search, and Edge defaults to Bing. Users can easily find defaults changed inadvertently, which is annoying, but Microsoft has a touch competitor (Google).

A reminder of Microsoft’s segments:

Productivity and Business Processes: Office, both commercial and consumer, including retail sales, volume licenses, Office 365, Exchange, SharePoint, Skype for Business, Skype consumer, OneDrive, Outlook.com. Microsoft Dynamics including Dynamics CRM, Dynamics ERP, both online and on-premises sales.

Intelligent Cloud: Server products not mentioned above, including Windows server, SQL Server, Visual Studio, System Center, as well as Microsoft Azure.

More Personal Computing: What a daft name, more than what? Still, this includes Windows in all its non-server forms, Windows Phone both hardware and licenses, Surface hardware, gaming including Xbox, Xbox Live, and search advertising.